When evaluating Investment Funds, use Dollar-weighted Returns

by Ben Lorica (last updated Jan/2012)

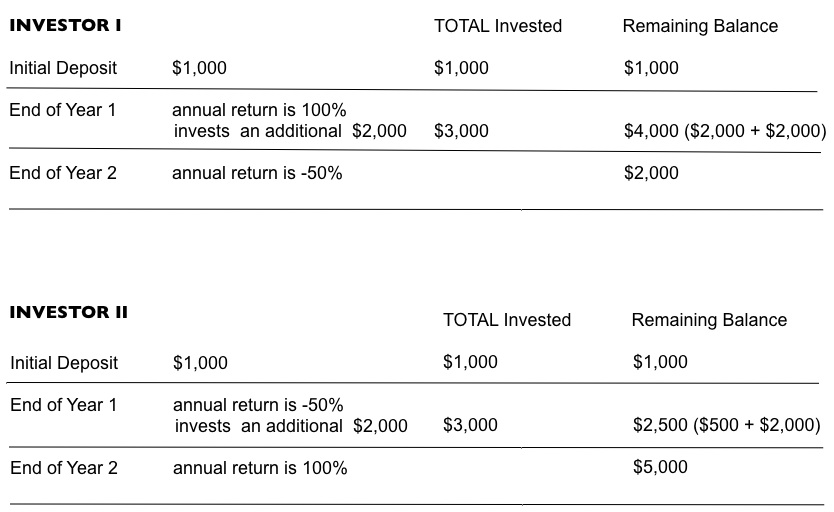

In this short note I've created a few graphics that illustrate some of the results in a 2011 paper by Dichev and Yu. They compare buy-and-hold returns favored by fund managers, with "... dollar-weighted returns (a form of Internal Rate of Return (IRR)) to assess the properties of actual investor returns on hedge funds". The Buy-and-hold return is the geometric average of (annual) returns, and remains the standard method for measuring fund performance.Why introduce a new metric? Below is a slightly rephrased example from Dichev and Yu:

Investor I: The buy-and-hold return on the fund over these two periods is 0% because initial investment doubled and then simply went back to its starting value1. The return experience of this investor, though, is clearly negative2 because he invested a total of $3,000, while he got only $2,000 out of it.

Investor II: The IRR of Investor II is 45%, this is the dollar-weighted investor return, i.e., the rate at which his initial $1,000 compounded over two periods, and at which his $2,000 invested at time 1 grew over one period. The buy-and-hold return is still 0% ( the initial investment halved at the end of Year 1, then doubled and finished at the same amount at the end of Year 2).

Buy-and-hold returns measure the return for a passive investor who joined the fund at inception and held the same position throughout. However most investors join the funds not only later but in widely uneven bursts of capital contributions. As I noted in a blog post, in aggregate hedge fund investors primarily "chase winners". They look at returns from recent quarters and move money from "cold" to "hot" managers. Unfortunately, once investors pile in and assets under management swell, most funds fail to live up to the hype and subsequent returns tend to disappoint.

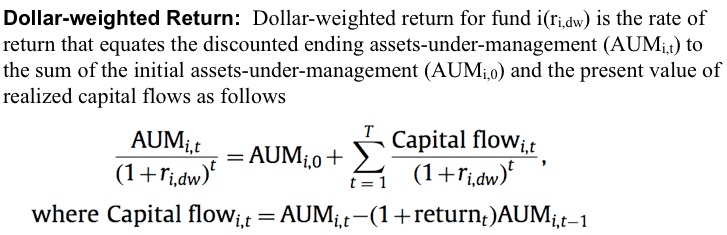

Clearly measuring performance using buy-and-hold returns, will fail to adequately capture investors' overall historical gains and losses. In comparison, Dollar-weighted returns are essentially returns that are value-weighted over time by the amount of invested capital; thus, dollar-weighted returns properly reflect the effect of the timing and magnitude of fund flows on investor returns.

Equal and Value Weighting

Dichev and Yu proceed to compare the two performance metrics (buy-and-hold vs. dollar-weighted return) on a large database of hedge funds. First they computed the performance metrics for individual funds and calculated the average (in the chart below, this corresponds to an Equal-weighted porfolio). Next they took into account the size of funds (as measured by assets under management) and the dollar-weighted return is computed by aggregating the inflows into individual funds and computing an aggregate IRR. In either case, the dollar-weighted return is much smaller than the industry standard metric (the buy-and-hold return).

Lipper-TASS and CISDM Hedge Fund Databases: Buy-and-Hold and Dollar-Weighted Returns

Summary

Using a simple example, and studies that show that hedge fund investors behave like momentum investors, it's clear why buy-and-hold returns fail to adequately capture actual gains and losses accrued by investors. Using the Lipper-TASS and CISDM Hedge Fund Databases Dichev & Yu show that the more accurate metric (the dollar-weighted return) is much lower than one favored by the investment industry (the buy-and-hold return). Investors, particulary ones who employ investment professionals (e.g., institutional investors & pension funds), should be using dollar-weighted returns in their fund/manager selection process.Related resources:

Hedge Fund profits flow mostly to Industry Insiders

Venture Capital Funds: Long-term Performance

Data Mining with the Maximal Information Coefficient

Hedge Fund Performance: My semi-regular blog posts on the Dow Jones / Credit Suisse Hedge Fund indices.

(1) Buy-and-hold return = ( (end - start) / start ) , is sometimes referred to as the end-to-end return.

(2) The IRR of Investor I is -27%, this is the dollar-weighted investor return.

Back to Resources page.

NOTE: Reproduction & reuse allowed under Creative Commons Attribution.