Hedge Fund profits flow mostly to Industry Insiders

by Ben Lorica (last updated Feb/2012)

Can you name an investor who has gotten very wealthy because of their hedge fund investments? Author and investment advisor Simon Lack has asked industry insiders this question for years, and nobody has given him a satisfactory answer1. Put another way, with many hedge fund managers amassing headling-grabbing fees/salaries, surely some investors have done well too.In his recent book, Lack takes a stab at estimating the share of profits that actually flow to hedge fund investors. In this short note I outline his methodology and also share a series of graphs that summarize his findings. The key metric that Lack tries to estimate is

Industry % Share of Total Profits ≡ (Total management + incentive fees) / (Total profits)A ratio close to 100% means that most of the profits are captured by the industry.

Methodology

Data: Start with database of hedge funds preferably one with broad coverage (Lack uses BarclayHedge, a database that begins in 1998). All these databases have problems (e.g., survivorship bias, managers participate at their discretion), so results have to be interpreted accordingly.

Fee/Profit calculation: You can attempt to compute fees/profits at the individual fund level (assuming you have access to fees charged and profits for individual funds). Lack aggregates fees and profits over all funds, essentially treating the industry as if it's one enormous hedge fund. Note that by treating the hedge fund industry as one large fund, Lack's estimates of incentive fees are on the low end2.

Fees: If you don't have detailed information about the fee structure of individual funds, you'll have make an educated guess. Lack uses "2 and 20" (2% management fee against AUM, 20% incentive fee against all profits). Lack also assumes 0 incentive fees after 2008, since many funds were well below their high water mark3.

Results

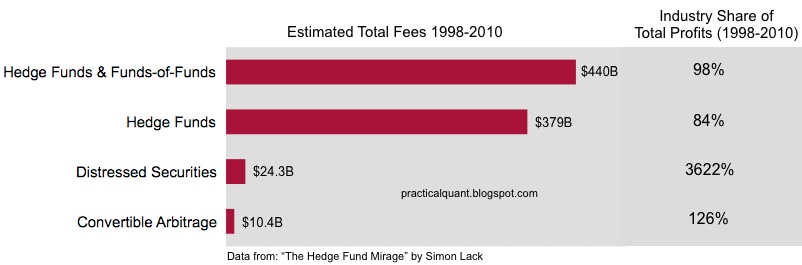

Using Lack's estimates, the Hedge Fund Industry captured 84% of total industry profits from 1998-2010, while raking in $379 billion in fees over the same period. According to Lack about a third of all Hedge Fund investors rely on funds of hedge funds ("Funds of Funds" or FOF). If you include the fees captured by the FOF's, then the industry captured 98% of total profits from 1998-2010. Lack applied the same methodology to the subset of funds that primarily trade using two particular strategies (Convertible Arbitrage & Distressed Debt), and found similar results4.

[NOTE: In the charts below, the line graphs for AUM & Profit were normalized to share the same starting value & scale. Displaying them together highlights their divergence: as AUM increase sharply, Profit tends to stay relatively flat or even decline.]

Industry % Share of Total Profits

& Average Total Assets Under Management (AUM)

BarclayHedge 1998-2010

[Source: The Hedge Fund Mirage by Simon Lack ]

Summary

Simon Lack's rough calculations show that over the last decade, hedge fund profits flowed mostly to industry insiders (via management/incentive fees). One could quibble with his methodology, but I appreciate the spirit of his calculations. Just as I emphasized dollar-weighted returns in an earlier article, I think it's imperative that investors use the metric defined above, when evaluating (alternative) investment opportunities: share of total profits captured by insiders. If the (hedge, VC, private-equity) fund manager is unwilling to share that data, it's a good signal to take a pass.Related resources:

When evaluating Investment Funds, use Dollar-weighted Returns

Private Equity Bakeoff: Buyout vs. Venture Capital

Venture Capital Funds: Long-term Performance

Data Mining with the Maximal Information Coefficient

Hedge Fund Performance: My semi-regular blog posts on the Dow Jones / Credit Suisse Hedge Fund indices.

(1) Among industry observers the question asked is: "Where are the customers' yachts?". Alas, hedge funds are similar to technology startups in that the largest payouts go to early stage (venture) investors (those who put in money early and negotiate a piece of all future fees/profits).

(2) Imagine an investor in 2 funds of equal size, one was up 10% the other was down 10%. Since total return is 0%, Lack's aggregate approach means the incentive fee would be 0. In practice the manager that was up 10% would actually charge an incentive fee.

(3) High water mark: "Almost all hedge fund performance fees include a 'high water mark' (or 'loss carryforward provision'), which means that the performance fee only applies to net profits (i.e., profits after losses in previous years have been recovered). This prevents managers from receiving fees for volatile performance, though a manager will sometimes close a fund that has suffered serious losses and start a new fund, rather than attempting to recover the losses over a number of years without performance fee."

(4) Distressed Debt industry insiders collected $24.3B in fees from 1998-2010. Total profits over that period was about $700M..

Back to Resources page.

NOTE: Reproduction & reuse allowed under Creative Commons Attribution.